The Main Principles Of Pvm Accounting

The Main Principles Of Pvm Accounting

Blog Article

Getting My Pvm Accounting To Work

Table of ContentsPvm Accounting Can Be Fun For EveryonePvm Accounting for DummiesSome Known Facts About Pvm Accounting.The Basic Principles Of Pvm Accounting Facts About Pvm Accounting UncoveredFacts About Pvm Accounting Uncovered

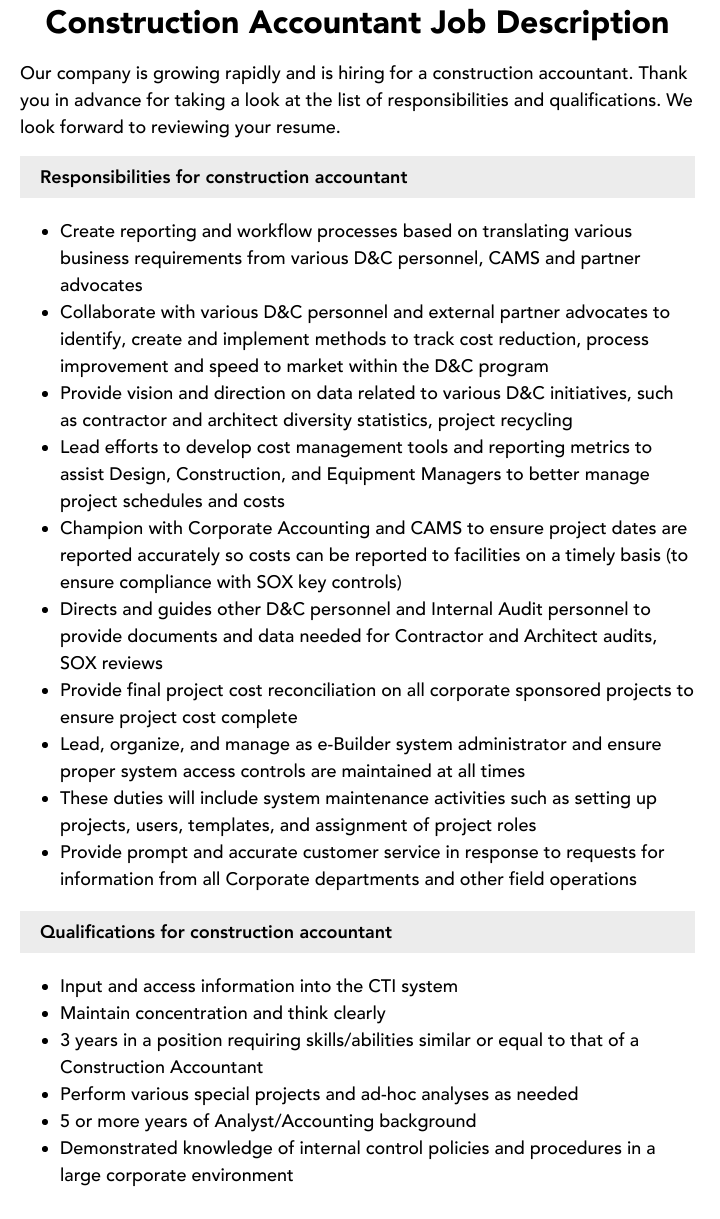

Oversee and deal with the production and authorization of all project-related payments to clients to cultivate great interaction and avoid problems. construction bookkeeping. Ensure that appropriate reports and documentation are sent to and are updated with the IRS. Ensure that the bookkeeping process adheres to the regulation. Apply called for building and construction bookkeeping standards and procedures to the recording and coverage of building activity.Understand and keep conventional cost codes in the audit system. Interact with numerous funding agencies (i.e. Title Business, Escrow Business) pertaining to the pay application process and demands required for repayment. Manage lien waiver disbursement and collection - https://giphy.com/channel/pvmaccounting. Screen and deal with financial institution concerns including fee abnormalities and examine differences. Help with carrying out and maintaining inner monetary controls and treatments.

The above declarations are meant to define the basic nature and degree of work being done by people designated to this category. They are not to be construed as an exhaustive checklist of obligations, obligations, and abilities called for. Workers might be required to perform responsibilities outside of their regular responsibilities periodically, as required.

An Unbiased View of Pvm Accounting

Accel is seeking a Building Accounting professional for the Chicago Office. The Building Accountant executes a variety of accountancy, insurance conformity, and project administration.

Principal duties consist of, however are not limited to, dealing with all accounting features of the company in a prompt and accurate manner and offering records and timetables to the firm's certified public accountant Firm in the preparation of all financial statements. Guarantees that all bookkeeping treatments and features are handled accurately. Responsible for all economic documents, pay-roll, banking and everyday operation of the accounting function.

Prepares bi-weekly trial balance records. Works with Project Supervisors to prepare and publish all monthly invoices. Processes and problems all accounts payable and subcontractor repayments. Produces month-to-month wrap-ups for Workers Settlement and General Responsibility insurance premiums. Creates month-to-month Work Price to Date records and dealing with PMs to integrate with Task Managers' budgets for each task.

Unknown Facts About Pvm Accounting

Effectiveness in Sage 300 Building and Property (formerly Sage Timberline Office) and Procore building administration software program an and also. https://www.dreamstime.com/leonelcenteno_info. Should additionally be competent in various other computer system software program systems for the prep work of records, spreadsheets and other accountancy evaluation that may be called for by administration. construction accounting. Need to possess strong organizational abilities and capacity to focus on

They are the monetary custodians who guarantee that building tasks continue to be on budget plan, follow tax laws, and keep monetary openness. Building and construction accounting professionals are not just number crunchers; they are calculated partners in the construction process. Their main role is to take care of the financial facets of building i thought about this and construction projects, making sure that resources are assigned successfully and financial threats are reduced.

Some Known Details About Pvm Accounting

By preserving a limited grip on task financial resources, accounting professionals help protect against overspending and monetary setbacks. Budgeting is a foundation of effective construction jobs, and building and construction accountants are instrumental in this regard.

Construction accounting professionals are fluent in these laws and make sure that the job conforms with all tax demands. To stand out in the role of a building and construction accounting professional, individuals require a strong instructional foundation in accountancy and finance.

Additionally, qualifications such as State-licensed accountant (CERTIFIED PUBLIC ACCOUNTANT) or Licensed Building And Construction Market Financial Professional (CCIFP) are extremely pertained to in the market. Functioning as an accounting professional in the building and construction industry includes an one-of-a-kind set of obstacles. Construction projects usually include tight deadlines, altering policies, and unexpected expenditures. Accountants need to adapt promptly to these challenges to keep the task's economic health undamaged.

9 Simple Techniques For Pvm Accounting

Professional certifications like CPA or CCIFP are likewise very suggested to show know-how in building and construction audit. Ans: Building accountants produce and check budgets, identifying cost-saving opportunities and ensuring that the project stays within budget. They also track expenses and forecast economic needs to stop overspending. Ans: Yes, building and construction accounting professionals take care of tax obligation compliance for building tasks.

Intro to Construction Audit By Brittney Abell and Daniel Gray Last Updated Mar 22, 2024 Building and construction business have to make difficult options amongst numerous economic choices, like bidding on one task over another, choosing financing for materials or devices, or establishing a project's profit margin. In addition to that, building and construction is a notoriously unstable sector with a high failing rate, sluggish time to settlement, and inconsistent cash money flow.

:max_bytes(150000):strip_icc()/forensicaccounting-Final-85cc442c185945249461779bcf6aa1d5.jpg)

Production entails repeated procedures with easily identifiable costs. Production calls for various procedures, materials, and devices with varying expenses. Each project takes area in a brand-new place with varying site problems and special obstacles.

Facts About Pvm Accounting Revealed

Long-lasting relationships with suppliers relieve negotiations and enhance efficiency. Irregular. Frequent use various specialized specialists and suppliers impacts effectiveness and capital. No retainage. Repayment arrives completely or with normal payments for the full agreement amount. Retainage. Some part of settlement may be held back till project completion also when the contractor's job is finished.

Regular manufacturing and temporary contracts result in manageable cash money flow cycles. Irregular. Retainage, slow payments, and high ahead of time prices bring about long, irregular cash circulation cycles - financial reports. While traditional makers have the advantage of controlled settings and enhanced manufacturing processes, building and construction business have to regularly adjust to each brand-new task. Even rather repeatable jobs call for modifications due to website problems and other factors.

Report this page